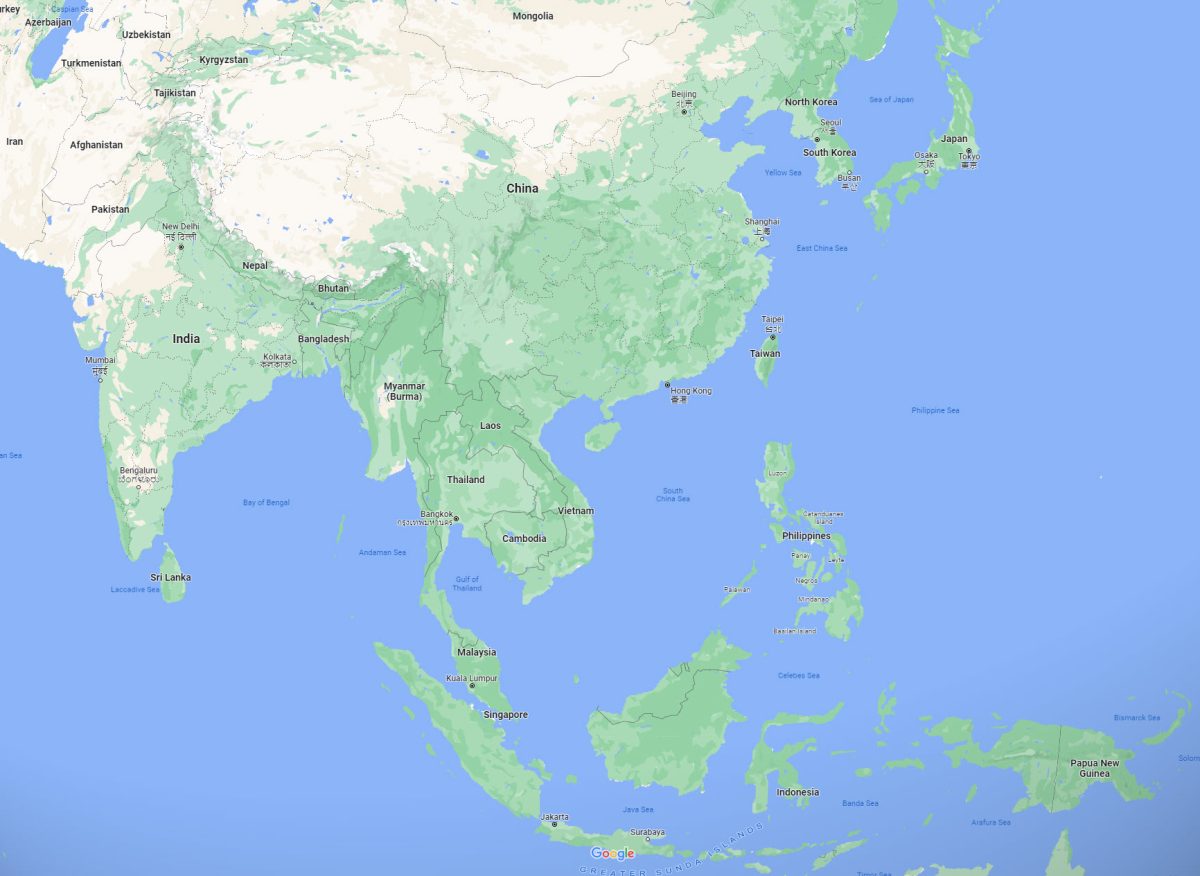

Advancing Green Hydrogen: Building the Foundations for Fuel Cell Vehicles in East Asian Cities

Achieving carbon neutrality by 2050 requires effective decarbonization of the transport sector, which currently accounts for around 30% of global energy use and 25% of the global energy-related CO2 emissions, according to IRENA[1].

Green hydrogen, in addition to electrification, is a key piece of the puzzle for transport decarbonization. While electrification has proven successful for light-duty vehicles, the challenge lies in decarbonizing heavy-duty road transport, shipping, and aviation. Green hydrogen emerges as a promising solution for heavy-duty vehicles, necessitating the development of robust policies, markets, and technologies. IRENA’s 1.5 C scenarios calls for a significant increase in clean hydrogen’s share in transport total final energy consumption to 12% by 2050 from the 0.1% in 2018[2]. In other words, the policy, market, and technology of green hydrogen need to mature in the next 30 years. To achieve the maturation of green hydrogen, governments hold the key to laying down the necessary policy foundations to support this transition.

National governments’ long-term strategies for hydrogen development

China, Japan, and South Korea have adopted national strategies to drive the development of hydrogen. These strategies aim to not only achieve climate targets but also enhance energy security and economic competitiveness. The components of these strategies include policy targets, R&D support, supply and demand expansion, and infrastructure development.

Table 1. Key national policies on hydrogen development in East Asia

| Countries | Key strategies (release date) |

|---|---|

| China | 2021-2035 Long-term Plan for the Development of Hydrogen Industry (2021) |

| Japan | The Basic Hydrogen Strategy (2017)

Strategic Roadmap for Hydrogen and Fuel Cells (2019) |

| South Korea | Korea Hydrogen Economy Roadmap (2019)

1st Basic Plan for the Implementation of Hydrogen Economy (2021) Hydrogen Economy Policy Direction (2022) |

Hydrogen development in East Asian metropolises

Actions at the city level are essential for realizing the objectives outlined in the national strategies. Just as cities have played a pivotal role in the expansion of electric vehicle fleets through various initiatives such as pilot projects, subsidies, and charging infrastructure development, they are expected to play a significant role in the development of hydrogen application in the transport sector.

Among the East Asian metropolises, Beijing, Seoul, and Tokyo have emerged as pioneers in fuel cell vehicle expansion and have valuable experiences to share with other cities.

Beijing has released two key policies, including the Beijing Hydrogen Industrial Development Plan (2021-2025) and the Beijing Hydrogen Fuel Cell Vehicles (FCVs) Development Plan (2020-2025). Through these plans, Beijing aims to have 3,000 FCVs and 37 charging stations by 2023 and 10,000 FCVs and 74 charging stations by 2025. Beijing’s hydrogen development plans include several key components, such as regional cooperation, pilot demonstration, and financial incentives. The city aims to collaborate with surrounding areas such as Tianjin and Hebei for hydrogen supply, while concentrating on technological innovation and demonstration projects. Beijing also selected several scenarios for FCVs demonstration, including the 2022 Winter Olympics and logistics centers. The city has also established subsidy criteria for hydrogen charging station development and hydrogen prices.

Fuel cell bus demonstration at Beijing 2022 Winter Olympics. Credit: Ofweek.com

To achieve net zero by 2050, the Seoul Comprehensive Plan for Climate Action (2022) targets a cumulative total of 40 hydrogen refueling stations and 34,000 FCEVs by 2026 – among which are 1,000 buses and 100 street sweepers, types of heavy-duty vehicles. To enable the transition, Seoul invested 8.2 billion KRW (around 6 million USD) with the aim of supplying 230 hydrogen passenger cars in the first half of 2023. The city will provide subsidies of up to 32.5 million KRW per car purchased. Buyers will also receive a variety of benefits including tax exemptions of up to 6.6 million KRW, reduced parking fees, highway and congestion tolls.

Fuel cell bus in Seoul (Source: Sustainable Bus)

In 2022, the Tokyo Metropolitan Government released the Tokyo Hydrogen Vision, which outlines the role of hydrogen in achieving Tokyo’s 2030 Carbon Half and 2050 Carbon Neutrality commitments. Tokyo aims to phase out the sale of new gasoline passenger cars, with FCVs serving as a replacement. Emphasizing the importance of green hydrogen, Tokyo plans to either import green hydrogen from other regions or produce it locally through water electrolyzers and using renewable power. Infrastructure development is a key focus, and Tokyo intends to collaborate with the national government to relax the restrictions on hydrogen infrastructure and support establishment of multi-energy stations and bulk filling facilities.

Image of multi-energy station. Credit: Tokyo Metropolitan Government

Each of these capitals has released long-term policies guiding the long-term hydrogen development in the transport sector. Tokyo, in particular, has outlined a comprehensive vision for hydrogen application. All three cities have taken actions such as FCV demonstrations, subsidies, and charging station development, resulting in the initial development of FCV fleets. Seoul, for instance, had nearly 3,000 FCVs by the end of 2022. However, further efforts are needed for these cities to achieve their near-term targets.

Table 2: Targets, actions, and progress of FCV development in the three capital cities

| Beijing | Seoul | Tokyo | |

| Number of FCVs | 1,528 (as of Aug 2022)[3] | 2,912 (as of 2022) | 1,434 (as of Feb 2022)[4] |

| Targets | 10,000 (by 2025) | 34,000 (by 2026) | No sale of new gasoline passenger cars by 2030 |

| Demand creation | Demonstration projects

Subsidies |

Demonstration projects

Subsidies |

Demonstration projects

Long-term roadmap setting a clear vision |

| Infrastructure development | Regional cooperation with surrounding areas

Urban planning for hydrogen infrastructure |

Support in charging station development |

Regional cooperation with surrounding areas Support multi-energy stations Collaboration with the national government |

Advancing towards mature hydrogen technology

While cities have initiated the implementation of their hydrogen policies, they face challenges in achieving their near-term targets. Addressing the following barriers is essential:

- Boost demand: How can we further stimulate the demand for FCVs?

- Learning from ongoing demonstration projects: What lessons can be drawn from the current demonstration initiatives?

- Engaging the private sector: How can we involve private companies, particularly in infrastructure development?

- Updating regulatory frameworks: How can cities, in collaboration with national governments, update regulations on hydrogen transportation, storage, and recharging?

- Exploring city-to-city collaboration: How can cities collaborate on joint projects to accelerate progress?

As a city-network focused on sustainable development, ICLEI East Asia is committed to supporting cities in overcoming these challenges. We will facilitate knowledge exchange, develop case studies, and provide guidance to foster the advancement of mature hydrogen technology in East Asian cities.

Authors: Xuan Xie (xuan.xie@iclei.org), Kayla Choi (kayla.choi@iclei.org)

[1], [2] IRENA, Transport decarbonization, https://www.irena.org/Energy-Transition/Technology/Transport#overview

[3] People.cn, Beijing: Striving to surpass 10,000 hydrogen-powered vehicles by 2025, http://bj.people.com.cn/n2/2022/1125/c349239-40209080.html

[4] Tokyo Metropolitan Government, Tokyo Hydrogen Vision, https://www.time-to-act.metro.tokyo.lg.jp/measures/en/hydrogen/